What is Payment Orchestration and how can it help your business

26 Apr, 2022·Remay ·Payments 101

Ever changing purchasing trends have led merchants to adopt more complex payment infrastructure that can service different pricing models, host multiple payment service providers and make hundreds of integrations to drive scalability.

However, not many Payment Service Providers (PSP) can support this complexity. A gap that is especially painful for merchants who operate internationally and need to manage multiple Payment Service Providers and Methods. Solving these problems is what Payment Orchestration is all about.

In this article, we’ll cover everything you need to know about Payment Orchestration and how you can use it to scale your business faster - with little to no engineering effort.

What is Payment Orchestration?

Payment Orchestration platforms (POPs), also known as Payment Orchestration Layers (POLs) are platforms that help merchants support and build the end-to-end process of collecting payments, from deploying Payment Processors to Accounts Reconciliation.

It’s an innovation to the digital payments space that is designed to help merchants future proof their payment flows. Using POLs, merchants can have a single API integration to manage Multiple Payment Service Providers and Methods. This removes the need for fragmented integrations and transaction data for each Payment Service Provider allowing a more flexible payment architecture that drives cost optimisation and revenue growth.

Why do you need a Payment Orchestration Platform?

Adapting to an ever changing customer demand is like playing Whac-A-Mole with your payment infrastructure. The need for new innovations always pop up to support better customer experience that translates to more sales while keeping payment operation costs down.

But what does a good payment function look like? Let’s have a look at these core goals of Payment Orchestration Platforms:

- Provide a frictionless checkout flow and increase sales by optimizing payment approval rates

- Scale and increase conversion by supporting the payment methods that customers prefer

- Reduce transaction and payment operations cost and increase company’s bottom line

- Leverage existing 3rd party applications to allow for optimized business operations

- Store and manage payments data from multiple PSPs in one ledger

These five overarching goals are your guide to developing a payment function that will bring the most impact to your revenue growth. Large, well funded incumbents typically have their own payments engineering team to deliver and constantly iterate on their payment operations function, however, this heavy engineering effort is scarce and expensive.

Best in class Payment Orchestration Platforms solve this problem by providing a little to no-code solution to help accommodate non-engineers to build payment flows that best suit their business needs.

What are the top payment challenges for merchants

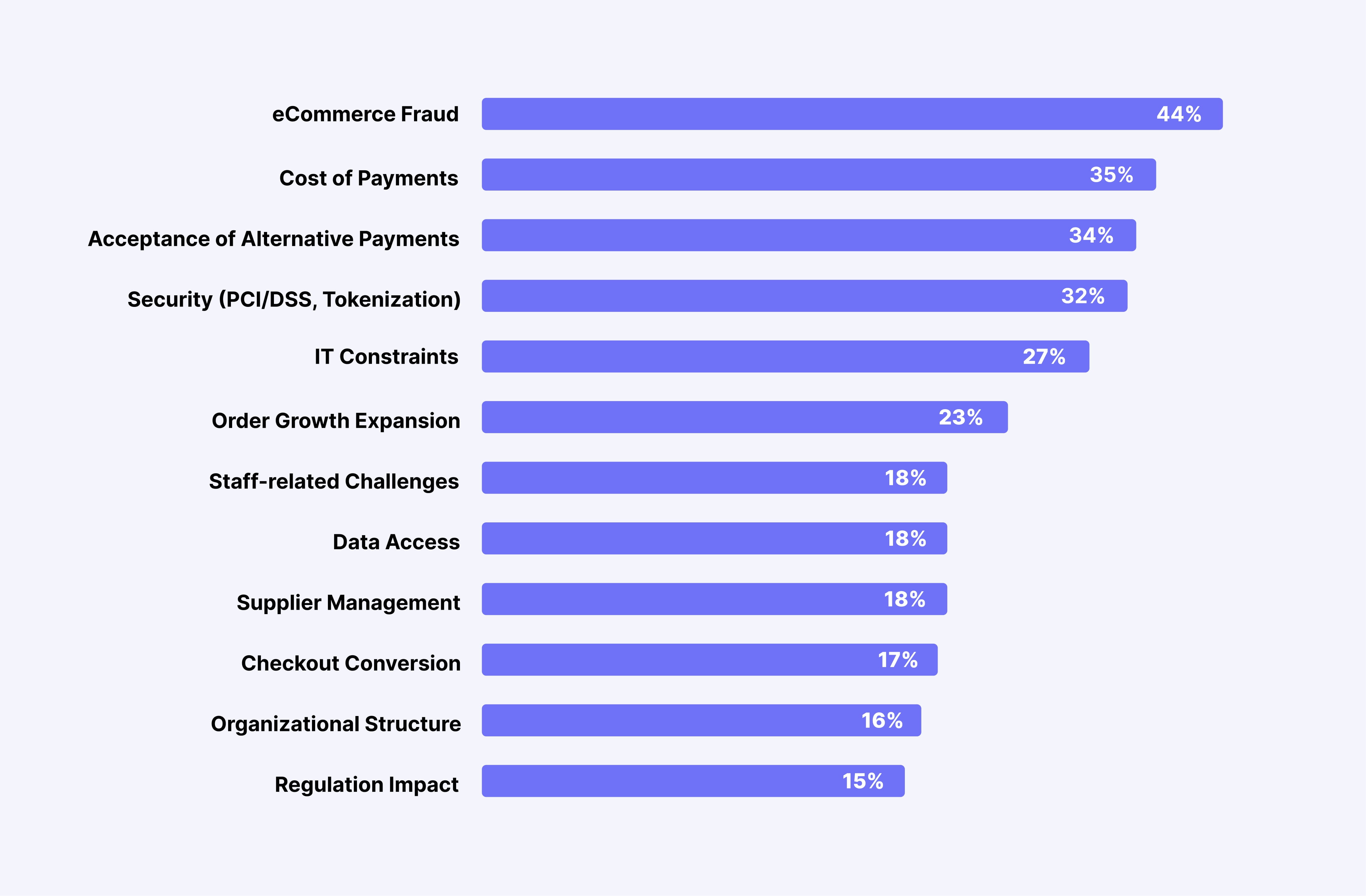

So what challenges quantify the need for Payment Orchestration Platforms? And what areas should you optimize? Here’s a quick at-a-glance look of the top payment concerns for merchants based on MRC and CyberSource’s Payment Management Strategies of Forward-Thinking Global Merchants survey:¹

Other challenges come from the lack of control over different payment stacks and access to a unified dashboard to manage all Payment Service Providers in one place.

This traditional, fragmented view of payment transactions makes it difficult to get actionable insights on your Payment function. On top of that, it adds more technical overhead to merchants as they need to build custom integrations for every Payment Processor to accommodate automations like managing fulfillment, invoice and billing systems.

Payment Orchestration Platform provides a single API integration to manage all your payment stacks in one place, thus reducing time and monetary resources spent on building these integrations separately.

However, the payment space is constantly evolving and services like WhenThen now provide a smarter and more user friendly version of the traditional Payment Orchestration Layer. WhenThen is a no-code payments platform that helps merchants build, scale, automate and future-proof payment flows and PaymentOps faster and without the dev effort. With a beautifully designed drag and drop canvas, non-engineers can now take control of their payment flows.

Let’s discuss how the traditional POLs are solving the above challenges and how it compares to WhenThen’s solutions in the next section.

How Payment Orchestration helps solve payment challenges for merchants

So how do POLs help merchants address these challenges? Let’s go through them in this section and introduce how WhenThen is disrupting traditional POLs:

1. Easily deploy anti-fraud Services

POLs help reduce payment fraud by allowing merchants to deploy and test out different fraud providers and 3DS rules without going through the tech overhead of building multiple integrations for each fraud provider.

WhenThen makes it easier by letting users instantly test out different fraud providers. We've pre-configured recipes with 3DS and fraud rules already set up that you can deploy in minutes and experiment on - reducing the dependency on the tech and fraud teams to orchestrate ideal payment flows that best mitigate fraud risks.

With WhenThen, merchants can inspect transactions, check for payment intents and make decisions based on the scores returned by our fraud providers.

2. Reduce Payment Cost

Payment processing fees are the cost incurred by merchants to process transactions. These are interchange fee, network fee, merchant account provider fee and fees incurred by the way the card is processed.²

In the survey that we’ve highlighted above, 'cost of payment’ ranks as the second biggest challenge faced by merchants and ‘cost per transaction’ as a top Key Performance Indicator across multiple merchant segments.

A big chunk of the overall payment cost comes from the interchange fee derived based on card type and network. While POL’s don’t directly affect interchange fees, how merchants process a transaction affects the overall payment cost. Some of the way POLs can help reduce cost are:

Minimizing Card Scheme Fees. Authorization Processing Fees are inevitable, VISA and Mastercard are going to take their cut, but there are hidden costs like retry penalties, 'misuse of authorization' and 'zero floor fees' that POLs can help eliminate.

These fees are especially painful for merchants with high authorization retry due to poor authorization retry logic as well as those who operate on a subscription base model which retries all declines multiple times indiscriminately.

With POLs real-time ledger, you can keep track of all authorization across different PSPs so you can run analytics and improve your authorization retry logic. POLs can also see when an authorization expires and match it with captures. This will help avoid ‘misuse of authorization' and ‘zero floor fees’. Through automations built through POLs, merchants can trigger actions that are best for cost optimization.

In the US, debit cards can be routed through local debit networks like STAR, NYCE, Pulse, or Accel for lower costs. It makes a lot of difference in fees to route debit card payments through debit networks - another use case for an external token vault to allow routing. PSPs offer connectivity to debit networks but limit the number of cards that qualify for debit network routing.³

Spot and Correct interchange downgrades. When you process a credit or debit card transaction, it’s being routed to a certain interchange category with corresponding rates and fees that processors use to calculate how much a transaction will cost. Every transaction should target an interchange category that offers the lowest rates for its transaction type. However, a downgrade happens when a transaction is being routed to an interchange category with a higher rate.

For example, if a Visa transaction’s target interchange category is CPS Rewards 2, but the transaction is not settled within 24 hours, it will downgrade to an interchange category called EIRF. The interchange rate associated with CPS Rewards 2 is 1.95%, but the rate associated with EIRF is 2.30%. In this case, the downgrade increases the cost of the transaction by 0.35%.⁴

A vast majority of downgrades are a result of your payment function’s processing logic – how it authorizes and settles transactions.

With POLs, merchants can detect downgrade possibilities so merchants can take corrective actions and avoid being routed to an interchange category with a higher rate.

Reduce Technical overhead cost. Businesses need to constantly adapt to new card scheme rules and to the ever-growing payment stack. This means a lot of dependencies on the tech team. However, payments engineers are scarce which makes maintaining the payment function expensive. POLs help build future-proof payment flows with little to no-code requirements so non-engineers can get a closer look at their payment flows, and build and make decisions that will best serve their business needs.

WhenThen supports cost reduction features of Payment Orchestration like smart routing. We’ve pre-configured recipes for payment routing and strategically decoupling authorization and capture to allow time to check order requirements like fulfillment availability, fraud score, or wait for customer signature before closing the transaction - reducing refund and chargeback costs. Technical and operational costs are also less things to worry about as WhenThen’s platform is designed to reduce dependency on your technical team to build simple to complex payment flows.

3. Easily expand to new markets and accept alternative payment methods

Expanding to new markets goes beyond just selling your products to new audiences. To secure the sale, it’s critical to offer local payment methods that customers prefer.

POLs’ single API integration gives access not only to card processors but also to other payment methods like bank transfer, e-Payments, e-wallets, and direct debit. Best-in-class POLs integrate a long-tail of payment methods and payment service providers for new target markets on merchants’ behalf, meaning a single POL API integration allows access to the latest payment methods customers demand and the processors most likely to approve transactions. This means merchants can stand up and launch new, regional-specific payment methods and processors in clicks, without your own integration project.

As part of the Payment Orchestration feature of WhenThen, merchants can easily add new PSP and alternative payment methods to support local targeting through a single API integration or through a PCI compliant payment form SDK and hosted checkout page to capture, vault and tokenize customer payment data and control your payment flow in real-time.

4. Increase checkout conversion through Smart Retries

You’ve allocated a significant amount of resources to get your users to checkout but failed payment is a challenge that happens more often than you’d like. You can combat this by building smart payment retry logic without the need for manual intervention and additional dev effort. Set your rules in the decision tree for retries and execute them automatically based on conditions that best suit your business needs. By implementing a retry logic, you can increase conversion by approximately 7-8%.

Smart retry is just one of the features that WhenThen offers to help merchants increase conversion rate. Our hosted checkout that merchants can configure and design within WhenThen simplifies adding new payment methods to align with the checkout optimization strategy.

5. Token Vaults to enable multi-PSP strategy

It’s the new normal to have multiple PSPs to remove dependency on one provider when outages happen. This helps increase the payment success rate by reducing payment failure when a PSP encounters downtime. POLs help detect these outages and automatically switch to an active PSP to save the sale.

However, having multiple PSPs means more complexity on the management of Primary Account Numbers (PANs) and tokens. Most PSPs provide tokenization services that merchants rely on to reduce their compliance with the card schemes’ security requirements. However, the tokens provided by one PSP cannot be used for another which means that retry logic using another PSP would be impossible.

Instead of hosting tokens at your PSP, POLs resolve this issue by providing an external Token Vault that can manage and store tokens, independent of PSPs. This means that you can use these tokens to process transactions across any payment processor, allowing you the flexibility to choose any processor to use - a feature that is at WhenThen's core.

6. Combat Chargeback

POLs help speed up chargeback resolution and decrease costs that come with it. Because POLs know everything about merchant transactions, it can detect potential chargeback and its status - i.e. ‘stale’ (a chargeback is submitted past the allowable time) or improper (a chargeback amount below a certain amount or a chargeback for a transaction already refunded).

Additionally, POLs allow merchants to connect 3rd party fraud providers with less dependency on the tech team and allow you to score and decline fraudulent transactions. Traditionally, payment operations teams review chargebacks by going through every PSP but POLs can centralize this in a single point to make the process a lot more efficient.

We’ve covered how WhenThen help deploy and test out fraud services. Through WhenThen’s platform, you can test out multiple fraud providers before launching to find the best solution that will give you the best results without the tech overhead.

7. Get full visibility and control of all your transactions with Real-time Ledger (RTL)

POLs provide merchants with a platform and tools to use to define accounting events and how to perform accounting entries for each transaction. Merchants and marketplaces can calculate revenue shares, per partner and transaction commission basis shares, how much is being paid in interchange and card schemes fees. This simplifies payouts to partners and reduces admin time spent on account reconciliation - cutting the overall operational cost.

WhenThen’s Real-time Ledger helps you monitor balances and transactions across all your payment and payout service providers in real-time. A single source of truth for all your PaymentOps team’s needs. Know where your funds are at all times. Get a breakdown of processing fees, marketplace fees, and FX rates. Reconcile with your bank statements and export reporting to streamline your reconciliation process.

How to get started with Payment Orchestration?

If you made it this far, congratulations! You’re one step closer to optimizing your Payment Operations. However, there's still a lot to be done on this front. But don’t worry, we’re here to help.

Payment Orchestrion is new and complex. The solutions you’ll find in the market will offer you just a fraction of what POLs can do. Some providers focus on cost and checkout optimization, which are great. But there's more to payments than that. Choosing the right provider is crucial as payments are a critical part of your business operation. For a lot of merchants, this means building a long-term relationship with the Payment Orchestration Platform.

If you don’t know where to start, WhenThen is your friend. We’re customer focused with features that go beyond just Payment Orchestration. We have PayGeeks who are experts in this field and we can help you get started faster - it’s free to book a demo or speak to our PayGeeks and try our service - you’d be surprised how much value you can unlock for your business.

Sources: 1. RPGC Group Research on Payments Orchestration Layer 2. Corporate Finance Institute Article 3. CMSPI Article 4. CardFellow Article

Explore more content

WhenThen

This blog is brought you to by our wonderful team. If you enjoy the content make sure that follow us.

Follow on twitter