Grow without the security, compliance and tech burden.

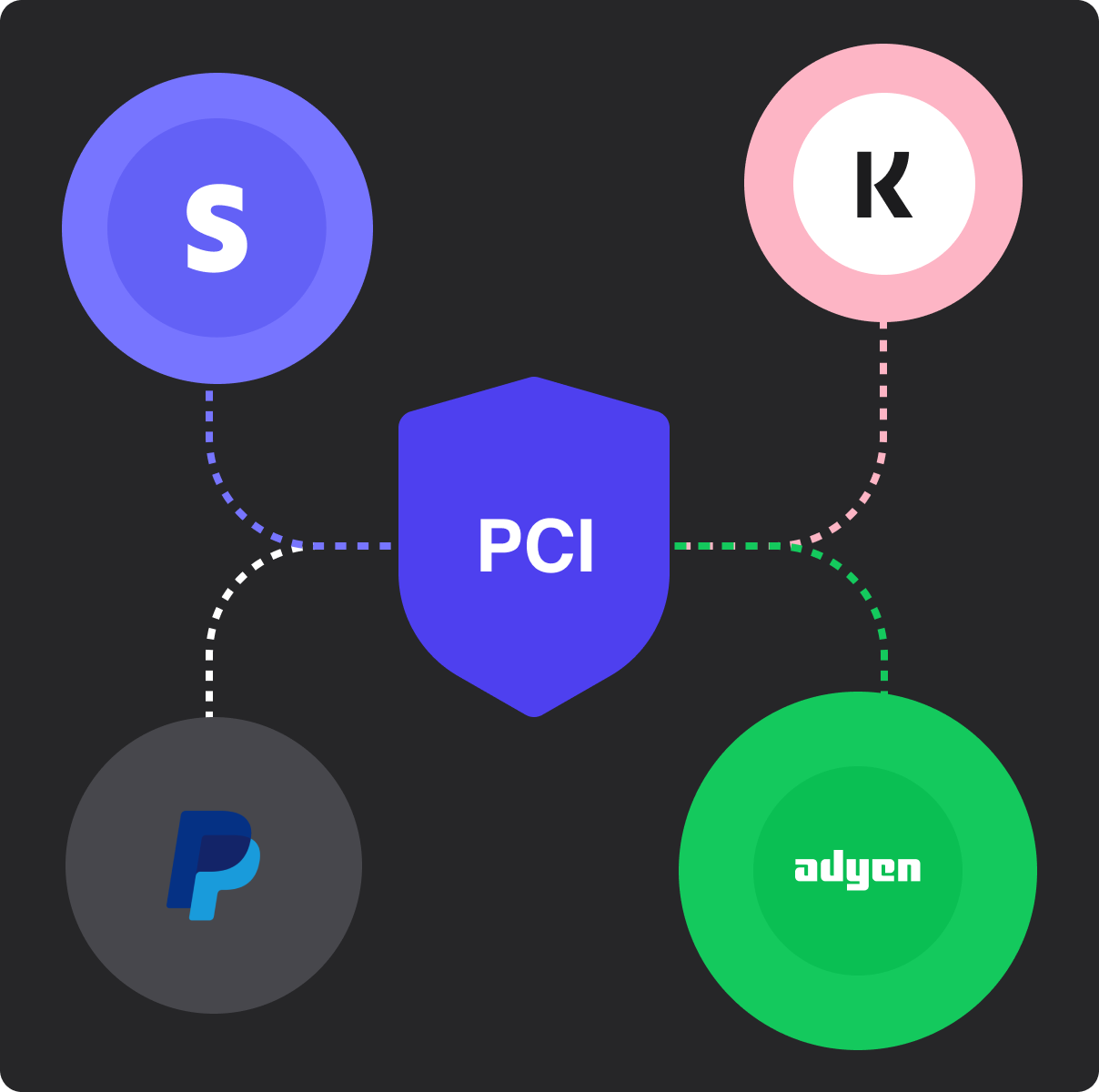

Have more control over your payments data to unlock hidden growth potential without the security and compliance burden. Use our PCI DSS Level 1 Vault to securely store and manage data while giving your team the flexibility to scale your payments product faster and without the tech overhead.

Connect + collect

Securely connect to your payment and business APIs and data.

Connect with any payment processor to collect or exchange payments data to avoid PSP data lock-in and support multi-processor routing to improve authorisation rate and reduce costs.

Capture + Tokenise

Capture, vault and tokenise through our PCI compliant SDK and pre-built components.

Network tokens

Network tokens is where payment security and a frictionless checkout experience meet

Reduce the risks of fraud and increase payment acceptance rate while keeping a frictionless checkout experience for your customer using network tokens.

Account updater

Ensure up-to-date payment information to reduce lost sales from stolen, expired, or lost cards.

Depending on your business needs, you can use our account updater to request for payment information updates from card networks. When a payment fails due to stolen, expired or lost cards, you can choose to automatically request for the updated details then retry the payment to save the sale.

Headless vault

Want to handle the payments logic yourself without the burden of PCI compliance? Now you can!

With Headless Vault you can use WhenThen’s PCI DSS Level 1 compliant vault to retrieve payment processor and network tokens, store payment methods and associate them with specific processors all while keeping your customer’s payment data secure and compliant.

Encryption Everywhere

Protect everywhere while maximising data usability

Sensitive card and personal data is always encrypted-at-rest by transport-layer security (TLS) and using AES-256 encryption.

And much more

Optional

WhenThen

stand-In

WhenThen Stand-In is an emergency failover process to ensure your payments are always processed.

Optional

On-premise or

private cloud

Run WhenThen in your own dedicated environment. An add-on to your enterprise plan, on-premise or private cloud is available anywhere a Docker image can run.

Optional

Region-based

servers

Require processing in a specific region? On the enterprise plan, regional processing is available almost anywhere.

Default

Access & audit

control

Grant specific access to functions and data in the app and review who’s done what and when.

Default

GDPR and CCPA

support

Full client support for your customers ‘right to access’ and ‘to be forgotten’ requests.

Default

High availability

By nature WhenThen is here to help prevent your entire payments stack being a single point of failure.

Other features

Tokenisation

Integrate the WhenThen Vault in days to own your payments data and tokenise personal customer data and payment information across global payment processors and card networks.

Orchestration

Paired with tokenise, use WhenThen’s universal payments API to access global payment processors and optimise your payments processing with routing, retries, refunds, redundancy, etc.

Automation

Use real-time transactional data and process events from across all your Payment Providers and other apps to automate and moderate payment tasks, issues and opportunities in real-time.

Operation

Use real-time standardised transactional data from across all your Payment Providers to build insights, reports, alerts and take action on payment issues through a single user interface.

Connectivity

We're building a wide selection of connections, from Payment Providers to business applications, to integrate your business.

Documentation

Collected and cleaned payments data accessible in a few clicks.

Get started in our sandbox environment for free.

Enjoy rich features and simple pricing that scales with you as you grow.