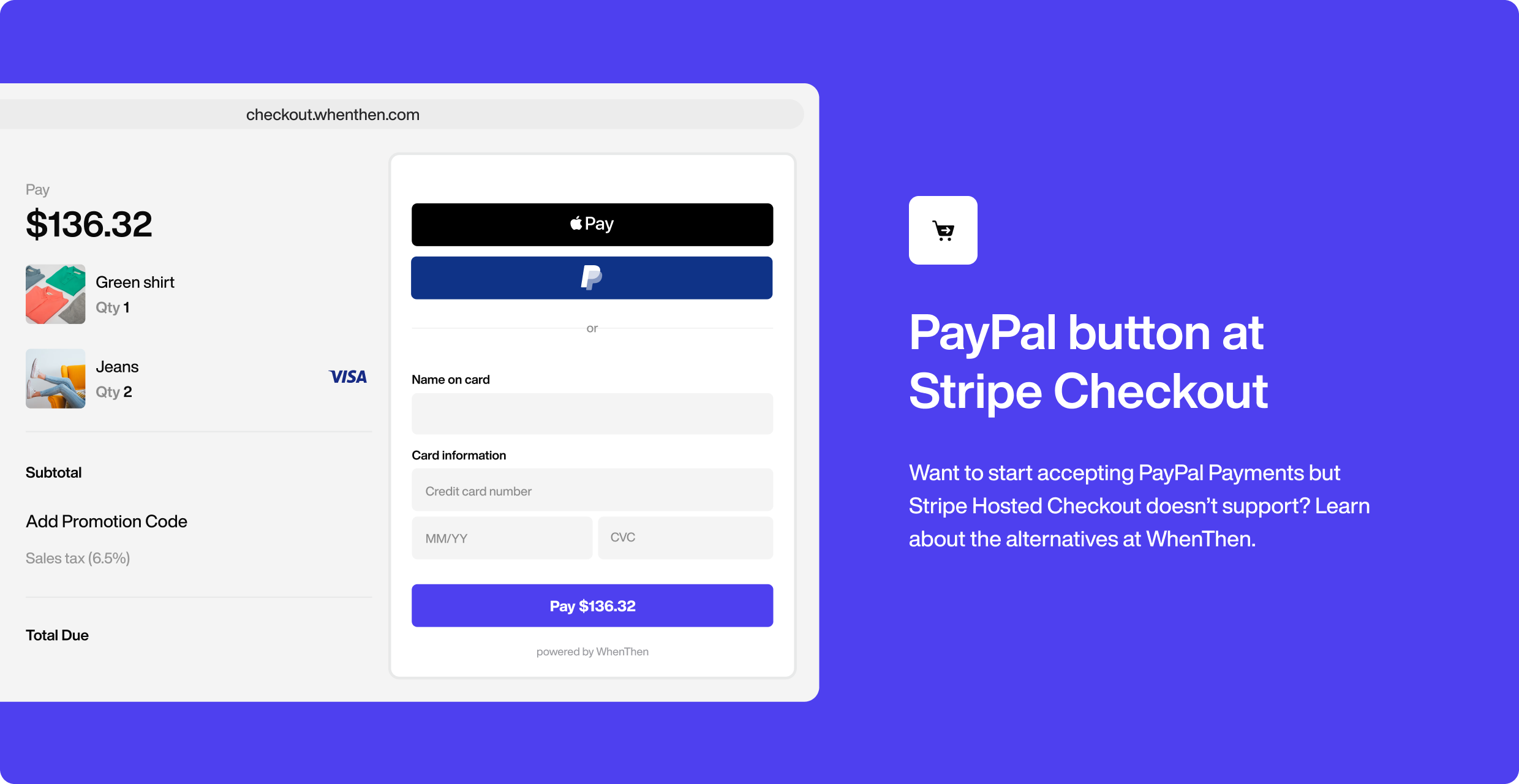

PayPal Button at Stripe Hosted Checkout| What's the alternative?

02 May, 2022·Remay ·Payments 101

With over 300 million PayPal users globally, it’s easy to quantify what you could be missing out on by simply not offering PayPal as a payment method at your checkout. In fact, in many locales, PayPal is still one of the most preferred methods of payment.¹

However, if you’re using Stripe hosted checkout, accepting PayPal as a payment method would be impossible as PayPal doesn’t integrate with Stripe. That said, if you want to start adding a PayPayl button, you can either use another hosted checkout solution that supports PayPal or build your own checkout page.

It’s also important to note that you can only process PayPal payments if you have PayPal set up as a Payment Service Provider which means that you’ll need to either switch to PayPal or ideally, have both PSPs.

While there’s almost no difference in payment processing fees between these providers, there are features that one or the other excels at and if you’re all set up with Stripe, migrating to another processor can be cumbersome.

Luckily, there’s an easy solution to have the best of both Payment Providers at your checkout. This is what we’ll explore in this article.

Adding PayPal and Stripe as PSPs

While there’s no hack to adding your PayPal button to Stripe’s hosted checkout, you can explore the option of using a less restricting checkout solutions and leverage it to have these PSPs seamlessly work together through a Multi-PSP routing strategy. One of the solutions you can look at is WhenThen’s hosted checkout. Let’s explore this in more details in this section.

Multi-PSP Strategy

New innovations in the payments space like Payment Orchestration, educate merchants on the value of having multiple payment providers to process transactions. This is because failed payments due to payment provider downtime happen more often than you’d want.

For instance, one of the largest American fast-food chains, Chick-fil-A's ended up giving away free meals to their customers during an outage with their Payment Provider, Fiserv. But this issue could be mitigated by having multiple providers available for failover.

Additionally, this challenge is not limited to payments through cards as dependency on one PSP extends to transaction lock-in o other payment methods. For instance, if you’ve added all other Alternative Payment Methods (APMs) through a single PSP, all of them will be unusable during an outage of that provider. The same issue occurs for managing your transaction data - even though your PCI compliance scope is reduced, having all data stored in one PSPs token vault brings a whole new level of dependency as this data can’t be reused for another processor making multi-PSP routing and data migration cumbersome and some data could get lost in the process.

This challenge is easily resolved through Payment Orchestration at WhenThen. WhenThen allows for a Multi-PSP Routing Strategy by giving merchants access to a platform where they can add multiple Payment Providers and any number of APMs while utilizing a PCI DSS level 1 vault to store, manage and allow reuse of transaction data.

Leveraging the routing strategy for cross-currency transactions

In the case of international payments, where authorization rates are typically lower in comparison to domestic payments, WhenThen helps merchants build Payment Flows that help route transactions with the highest payment success possibilities.

The same can be applied to FX routing where you can configure in the decision tree how cross-currency transactions will be processed while having cost and risk factors in mind - all through our no-code canvas.

Building a Multi-PSP routing logic at WhenThen

Multi-PSP routing is such a powerful feature with immense cost and risk-saving capabilities, it’s worth diving deeper into how you can leverage it to future-proof your payment operations.

If you want to start implementing it from the ground up, you'd need a group of payment experts and engineers - resources that are often scarce and expensive. Luckily, you have WhenThen to reduce this dependency for you.

Using WhenThen's no-code platform, you can:

- Add new PSPs and Alternative Payment Methods with less code

- Drag and drop the end-to-end re-routing flow on our no-code canvas

- Easily test out and launch faster

- Allow A/B testing to find which payment flows or payment providers bring the best results

Alternatively, you can start with our quick to set up, pre-configured payments recipes which you can implement in minutes.

Or Speak to our team and find out how we can help you add routing strategy in your payment flows and start seeing results in no time.

Sources:

Explore more content

WhenThen

This blog is brought you to by our wonderful team. If you enjoy the content make sure that follow us.

Follow on twitter