Payment Optimisation in 2022

11 Sep, 2022·Remay ·Insight

Do you get a lot of declined payments, customers abandoning checkout, or chargebacks and disputes? If so, perhaps it’s time to audit your payment flows to find key optimization gaps.

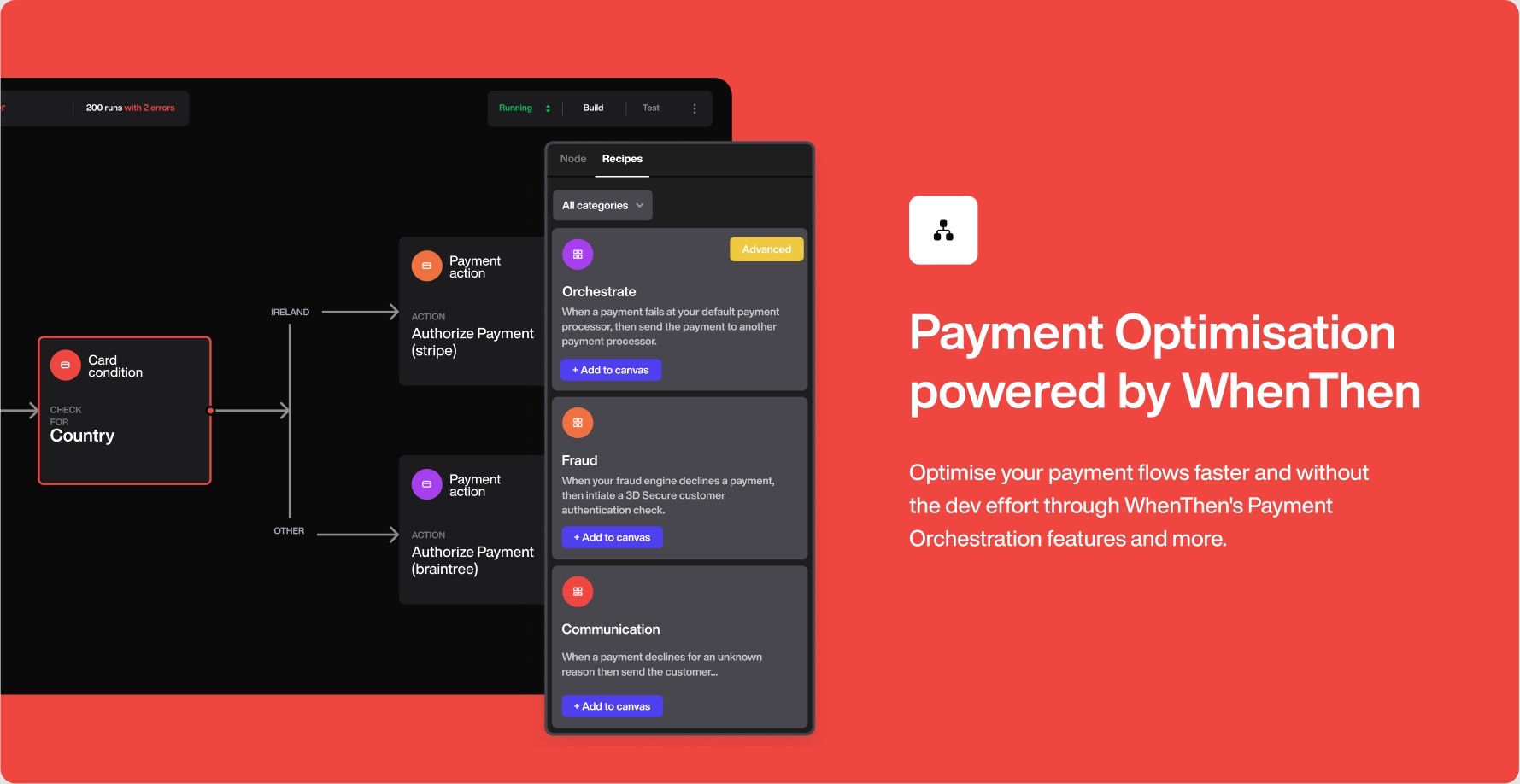

In this article, we'll explore how you can optimise your payment stack without the dependency on your tech team. We'll also explore the key role Payment Orchestration plays when optimising your end-to-end payment operations.

Payment Optimisation through Payment Orchestration

Payment Optimisation starts from running analytics on your payments data to get actionable insights. If you have your data well aggregated, you can start looking at areas like cost, revenue and risk optimization.

Merchants use payment optimization to differentiate from their competitors, especially in an oversaturated market. By enhancing the way you collect payments, you can deliver a frictionless customer purchasing journey and reduce unnecessary costs that slow down your growth. In other words, more money for your business.

Payment Orchestration Platforms (POPs), also known as Payment Orchestration Layers (POLs), are services that help merchants support and build the end-to-end process of collecting payments, from deploying Payment Processors to Accounts Reconciliation - meaning, everything that you need to run a flexible payment flow that meets both users and business needs.

With Payment Orchestration Platforms you can:

1. Build smart payment routing logic

Being able to have control over how your payments are being routed is one of the top ways you can optimise your payment flows. By doing so, you can unlock cost-saving benefits like avoiding high-cost interchange categories or simply route to a cheaper payment processor.

2. Easily offer the payment methods that users prefer

By offering the payment methods that your customers prefer, you can increase the chances of a successful conversion and reduce the number of abandoned checkouts. POLs can help merchants easily deploy new payment methods and manage them all in one place.

3. Access to real-time payments data

Having access to payments data in one unified ledger gives you the power to easily point out areas for optimization in your payment flows. POLs provide you the platform to have well-aggregated payments data of all payment service providers, processors, and methods - something that not a lot of Payment Service Providers offer.

4. Reduces PCI Compliance

When you have multiple PSPs, you run into the problem of having custom integration and token vault for every one of them in order to comply with card scheme regulations. However, with POLs you can have a single integration to connect them all. Different PSPs have their own token vault that stores transaction data but this cannot be used for another PSP which means payment routing won’t be possible. With the help of POLs, merchants can now store and manage data in one reusable token vault to allow smart payment routing while keeping the data secured and your payment systems compliant.

5. Easily add a security layer to decrease payment fraud

Fraud false positives mean lost sales and more resources spent on disputes and refunds. Challenges that spell out more operational overhead and slowed revenue growth. POLs help deploy and test out anti-fraud service providers faster and with less technical overhead.

These are just some of the ways payment orchestration can help merchants optimise their payment flows. If you want to dive deeper into this topic, we recommend reading our recent article where we explain how POLs can help solve payment challenges for merchants. In the next section, we’ll discuss how you can get started with Payments Orchestration faster and without code.

Is there a fast, low-cost route to optimizing your payment flows?

Using Payment Orchestration Platforms means breaking the chains that are keeping merchants tied to the traditional unsustainable payment ecosystem.

If you want to start implementing a Payment Orchestration Layer faster and with no code, WhenThen is your friend. We’re customer focused with features that go beyond just Payment Orchestration. We have PayGeeks who are experts in this field who can help you get started faster - it’s free to book a demo and try our service - you’d be surprised how much value you can unlock for your business.

Payment Orchestrion is new and complex. The solutions you’ll find in the market will offer you just a fraction of what POLs can do. Choosing the right provider is crucial as payments is a critical part of your business operation. For a lot of merchants, this means building a long term relationship with the Payment Orchestration Platform. Choose wisely!

Explore more content

WhenThen

This blog is brought you to by our wonderful team. If you enjoy the content make sure that follow us.

Follow on twitter